Search This Blog

Wednesday, July 31, 2013

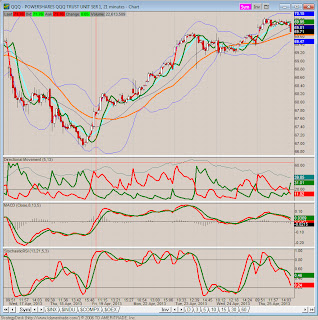

July 31st QQQ 21 Minute Intraday Chart

End of July Trends

The thick pink lines on each chart denote either a trend, a support, or a resistance.

AMD looks like they broke below resistance on the weekly

July 31st, 2013

The Fed finished up a two day meeting, and the market was waiting with bated breath to hear what Bernanke had to say at the end of it. Bernanke announced that while the economy is growing, it is not growing at the pace they would "like to see" so the Fed will continue pumping money into the system via it's bond buying program to keep inflation and interest rates in check.

GDP for the 2nd quarter grew at 1.7%. Originally, 1st quarter GDP was reported at 1.8%, however it was revised down to 1.0% today. SO.... after revising the 1st quarter number down, 2nd quarter GDP grew at a faster rate. Seems rather convenient to me, but I'll take it.

Personal savings rates are up to 4.5%, which is good for the economy's long term health.

Unemployment is currently at 7.6%, and is expected to report in at 7.5% on Friday. So keep a close eye on those Friday unemployment numbers to see if there are any surprises.

The markets themselves remained relatively flat today. There was a massive up-swing to start the day (lasted all of amateur hour from 9:30 to a little after 10:30), followed by a massive sell-off into the Fed's 2:00 meeting, followed by a massive up-swing after the announcement that lasted till 3:00, followed by a massive sell-off in the final hour of trading between 3:00 and 4:00. Institutional investors usually play in the last hour of trading each day, so I'd say this sell off is a good indication that institutions are going to unload their wares.

And here's a 5 minute chart of the DOW today...

Monday, July 29, 2013

July 29th, 2013

Wednesday, July 24, 2013

July 24th, 2013

Thursday, July 18, 2013

Intraday NASDAQ Futures Charts (July 18th, 2013 - CLOSE)

See this story on Bloomberg's website.

Basically, the futures fell following the release of Google's (GOOG) and Microsoft's (MSFT) earnings results. Both companies posted strong disappointments. No wonder, every company under the sun (Google included) are trying to figure out how to wring more money out of advertising on tablet devices.

Microsoft seems to have no end of bad news these days. Windows 8 is a MAJOR disappointment on both tablets and desktops. So they effectively failed at cracking the ever-growing tablet market, AND managed to alienate long time desktop users. The announcement of the Xbox One alienated over 10 years of gamers who dedicated themselves to the Xbox brand. About the only thing Microsoft has going for them is Office which, let's be honest, not everyone is tied to like they were in the late 90's and early 2000's. There's Internet Explorer... which every internet geek worth their salt knows is junk. Sorry Microsoft, you need to innovate before you go under.

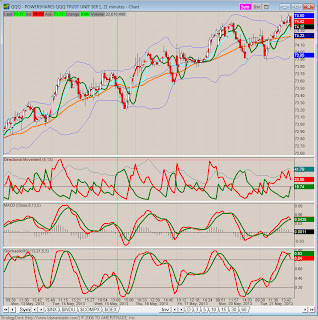

QQQ 21-Minute Update

From the chart below, it looks like QQQ broke below the supporting trend line to the down side, tried to recover, hit it's head on the trend line (confirming it has now become resistance), and is now set to head back down.

And the chart...

July 18th, 2013

On the whole not much news came out. Google (GOOG) missed on earnings by a pretty wide margin. This was mainly due to a decline in revenue from their ad service.

Financial stocks continued to pour it on strong this earnings season, with Morgan Stanley (MS) reporting a very strong beat on their earnings. So far this earnings season, 75% of financial stocks have actually BEATEN their estimates, making a good case that the financial sector is coming on strong.

Bernanke made more comments today, who stated that the Fed's plans for winding down the stimulus were "not set in stone." Basically this is a re-iteration of what he said before, that the Fed plans on ending Quantitative Easing, but will do so with discretion so as to not cause a panic in the markets.

Finally, the city of Detroit officially declared Chapter 9 Bankruptcy today. This makes Detroit the largest city in history to ever declare bankruptcy. I mean come on, who didn't see this coming like 5 years ago? I pretty much knew this would happen, I just didn't think it would take this long to happen.

Oh, and for the BMY chart ;) lol

Wednesday, July 17, 2013

July 17th, 2013

SanDisk reported a large jump in earnings. IBM reported a small jump after taking into account cost cutting measures, however they did state that growth was non existent in their "growth markets", indicating a slow down there.

Intel announced today that we should expect "little to no growth" for the rest of the year out of them. This is symptomatic of the boom in the tablet market. A lot more people are ditching traditional PC's for tablets. I personally like having a PC and a Tablet, a PC makes a better work horse. Having said that, a tablet can do about 90% of the things I need to do on a computer, so it's a nice substitute in most cases.

If Intel REALLY wants to compete they should start making tablet chips lol.

June housing starts fell 9.9%, which was much sharper than what anyone expected. It looks like just when the housing market was gaining some steam, it's been hit below the belt. Some blame Bernanke's comments for stalling the housing market, some blame the economy in general.

Bernanke announced today that the Fed WILL taper it's quantitative easing by the end of the year. He did say, however, that the Fed will do so within reason and won't do anything to jeopardize an economic recovery. Bernanke's sent the markets on a roller coaster ride with his comments about QE. First he says we'll do it, then we won't do it, now we will do it but "within reason." Someone get the market some head medicine, I think it's turning schizophrenic lol.

Finally, the moment you've all been waiting for, a daily chart of BMY to see if I'm right...

Looks like a Fat Pitch going down, coming off the middle bollinger band and coming off a down trend line. Prime time to buy some PUT options.

Monday, July 15, 2013

July 15th, 2013

News items for the day include China reporting a 7.5% advance in their country's GDP, which was in-line with estimates. Citigroup, one of the largest banks in the country, posted better than expected profit and revenue for the most recent quarter. This is a good sign for the banking industry in general.

On the whole though, most of the market was quiet and seems to be waiting in anticipation for a possible short-term dip. I'm still bullish long term, but short term (ie: the next month or so) I think we'll see stocks dip.

Oh and just to take another look at BMY to see if my prediction of it going down will come true...

Friday, July 12, 2013

BMY Update (07-12-13)

Glancing at the chart below (thank you Think or Swim!) it looks like the recent up move is stopping, and it looks like it's stopping on a down-trend resistance line. I don't have one drawn on this chart, but just connect the tops of the candlesticks and you'll see it...

July 12th, 2013

I've switched to using Think or Swim instead of Strategy Desk and the difference is like night and day. I don't know what it is, but once I got the charts set up in Think or Swim with my parameters they're just somehow easier to read and interpret. Same damn parameters, easier to see... I don't get it, but I'm going to go with what works.

No major news today. There were a couple of articles I saw today detailing how there is divergence within the Fed as to how to stop the Fed's bond-buying program. Everything from Bernanke's own comments to FOMC meeting results, however, show that Quantitative Easing (QE) should begin to taper in mid 2014.

Another article I read today is one man's opinion on how rising interest rates will hurt the housing and mortgage markets. Yeah this could happen, but rates are still historically low from where they have been, and I don't see this "hurting" so much as "slowing down a boom."

Thursday, July 11, 2013

July 11th, 2013

Bernanke said "Highly accommodative monetary policy for the foreseeable future is what’s needed in the U.S. economy." Which, translated into layman's terms, means the Fed will still keep the stimulus and bond-buying train running as long as they deem it necessary. So not only was yesterday's dip wiped out, but now it looks like the market is back on it's "full speed ahead" mode. I would hate to be trading to the down side right now.

Another piece of positive news today involved our own government, who announced a $117 Billion budget surplus for the month of June. Very impressive considering they were anticipating a $39.5 Billion surplus. Granted, about $59 Billion of the surplus came from Fannie Mae, who paid back a huge chunk of the bailout money they received during the financial crisis.

As long as the positive hits keep coming and the Fed keeps pumping money into the system, there's no telling how high the market will go. I guess it's wise to be aiming up until the next FOMC meeting, where I'd sell and await further commentary from Bernanke, since he apparently can sway the markets very VERY easily.

Wednesday, July 10, 2013

July 10th, 2013

Other minor "news" today included reports that the Federal government is taking a bigger and more active role in cracking down on insider trading.

Additionally, a report came out that (compared to other currencies on an international/global scale) the US dollar is loosing the "race to the bottom." Basically, a weak US dollar actually is a good thing because it means goods manufactured in the US are cheaper for other countries to buy, so other countries are more likely to buy goods we export. A strong US dollar means we are more likely to purchase goods from abroad rather than domestically. So essentially the report indicates that the dollar is strengthening, which means a likely increase in purchasing imports and a decrease in how many exported goods are purchased from our country.

On the whole the markets finished flat today. The DOW ended the day down $8.68 or -0.06%. The S&P 500 finished -$0.30/-0.02%. The NASDAQ finished up $16.50 or +0.47%.

BMY Practice Trade Update (07-10-13)

It looks to me like BMY is still going to go down, as is most of the market. Currently I think the market is topping out and getting prepped for a down move, it just isn't happening RIGHT NOW. But that's what's so critical about trading options - since they have a time decay element, I have to be right RIGHT NOW.

Anywho here's the daily chart...

Basically BMY is on a definite down trend for the near term, but it does have a fat pitch headed up indicating a sniper trade. I would expect this up move to last anywhere from 1 to 5 trading days, then dissipate and continue heading down. Even if this comes to pass, I STILL should have exited the trade with the 21% gain, because then I could have waited this up move out and re-entered the trade to go down AGAIN when it heads back down.

Just remember - this is what practice trades are for. You can take your lumps and kick yourself without actually loosing money. Just remember to treat it as though it were real so you can get your own emotions involved - fear, greed, etc.

Monday, July 8, 2013

BMY Practice Trade Update (7/8/13)

Basically I missed one trading day (Friday, July 5th) and apparently missed a strong move counter to my position. If I had closed my position before entering the hospital I would've been looking at a modest 21% GP on the trade. As it stands I am currently looking at a loss of $91 or 8.5% since the current bid/ask sits at $1.40/$1.42.

The charts, however, show that the bounce against me was purely technical off the lower bollinger band, and things SHOULD continue in the downward direction in my favor. And the chart...

July 8th, 2013

Most of the news today revolved around the opening of Earnings Season, and how Alcoa (AA) lead the charge with a strong beat both on profits and on revenue. A lot of the rhetoric coming off of Wall Street is they expect a strong earnings season, so we'll see if that materializes.

On the negative side, rates for mortgages have climbed, making mortgages more financially unattractive than they had been. This comes on the heels of news that the housing market in general is making a recovery.

On the whole kind of a soft news day, although it'll be interesting to see how this earnings season plays out...

Thursday, July 4, 2013

BMY Practice Trade Update

At the close on July 3rd, the bid/ask of BMY was 1.85/1.89 for a total position size of $1,295 or a GP of 21% so far.

And the chart...

Tuesday, July 2, 2013

Practice Trade - Bristol Meyers Squibb (BMY)

I'll be entering a practice put option trade on BMY using August puts that are one strike price in the money. The stock is currently at $43.99 so I will be using the August $44 Put options with a Bid/Ask of $1.50/$1.53. The options symbol is BMY_081713P44 for reference.

My current position size will be 7 contracts at the ask of $1.53 for a total position of $1,071.00. I will immediately put in a GTC sell order shooting for a 30% Gross Profit on the trade, making my GTC target on the position a Bid price of $2.19 or a total position size of $1,533.00.

And the chart...

July 2nd, 2013

In major news today, housing prices rose 2.6% from April to May of this year, and comparing May of 2013 to May of 2012, housing prices rose 12.2%. This is very good news for the housing market, and very good news for the broader economy in general. Housing price increases indicate housing sales, and housing sales mean a boost to the broader economy. Even if the homes being sold are existing homes, people need to buy appliances, furniture, electronics, decorations, etc. to put in the homes they buy. So, home sales give a nice boost to the broader economy in general.

Also today, it was reported that auto sales for June were stronger than anticipated with most major auto makers reporting meeting or beating their sales forecasts. Auto sales account for over 10% of all retail sales in America, so a strong auto industry is a good sign for the economy in general as well.

On the whole, though, looks like trading activity is still light with it being summer time, especially with everyone gearing up for the Fourth of July in a couple of days. Most people probably are heading to the beach instead of trading (must be nice, huh?).

Anywho maybe we'll all be in that same situation some day. Would be nice eh?

I wanted to post a picture of AAPL's stock as well. Looks like they're still heading up, and I marked in pink an upper resistance level and a lower support level. Looks like the stock is coming off a lower support of around $390 and has an upper resistance of around $450. It's currently trading at about $423 so it's got a little bit of room to run before it hits that ceiling.

QQQ Intraday 21 Minute Charts (March 2013 through June 2013)

Since I am currently unemployed thanks to my health, I will be able to study and practice intra day QQQ plays as well, and I'll be posting my results here so I can track them wherever I go!

QQQ Intraday Rules

1) Use the 21 minute chart as the decision chart

2) Use the 1 minute chart as the action chart

3) Use the Nasdaq 55 minute futures chart as the trend chart

4) Purchase options either 1 strike price in the money or 1 strike price out of the money. Only buy out of the money if it's within like 10 or 20 cents of being out of the money.

5) Buy options that expire this month only.

6) Enter the trade when the bid/ask spread is no more than 5 cents apart.

7) Place a GTC sell order 15 to 20 cents higher IMMEDIATELY after the trade has been entered. In the example given, the 15 cents higher was enough to make a 25% profit so a 25% profit may be a more accurate goal.

Monday, July 1, 2013

July 1st, 2013

Decided to get back into the swing of things on daily updates to the journal. Looking at my daily charts, pretty much every stock on my watch list is moving sideways following strong upward movements. This suggests that most stocks on my list are topping out until they either move down or continue going up... for now they are "resting."

The lone exception to this on my watch list is Apple (AAPL). Apple has been clobbered for quite sometime, and actually appears that it may be at the bottom of it's decline. Of course it's too early to confirm this yet, but it's the only stock on my list that A) isn't going sideways and B) isn't at the top of an uptrend.

Anywho, the Fed has made announcements that they may reduce some of their Quantitative Easing policies which has the markets a little spooked, hence why I think they're moving sideways right now. That and it's summer time, I think everyone sold in May and went away (to use an old market adage). This also explains why a lot of the moves the last couple of months have been quick up and down with little long term sustainability. The long term (gravy!) plays should resume in the fall after labor day. Until then, probably best to stick to the 55 minute charts for trading and get in & out same-day.

Not a whole lot of news today beyond a couple of manufacturing reports that spun a positive outlook on things. The ISM reported at 50.9% when it was forecast to be 50.5% (a 0.4% positive surprise) and construction spending met it's forecast of 0.5%, a nice increase from the prior reading of 0.1%.

The only other noteable news item was that Zynga's CEO stepped down, and was replaced by the former head of Microsoft's Xbox division Don Mattrick. Mattrick is the one who famously quoted in regard to Xbox One's originally "always on DRM" that "if anyone wants to play games without internet, they should get an Xbox 360." Basically, all the bad ideas at this year's E3 that were on display when Microsoft announced the Xbox One were his fault. If I were Microsoft I'd say good riddance. The man's ideas managed to alienate and undermine almost a decade's worth of work that Microsoft has performed to etch out a market for the Xbox brand. And actually this works out well for Zynga since Zynga revolves around free-to-play web based games that earn most of their money from micro transactions.